what is open closed-end credit

Open End Credit vs. Both closed end and open end credit are well-suited to certain needs.

Closed End Credit Awesomefintech Blog

Let us start by understanding the terms close-end- credit and open-line of credit.

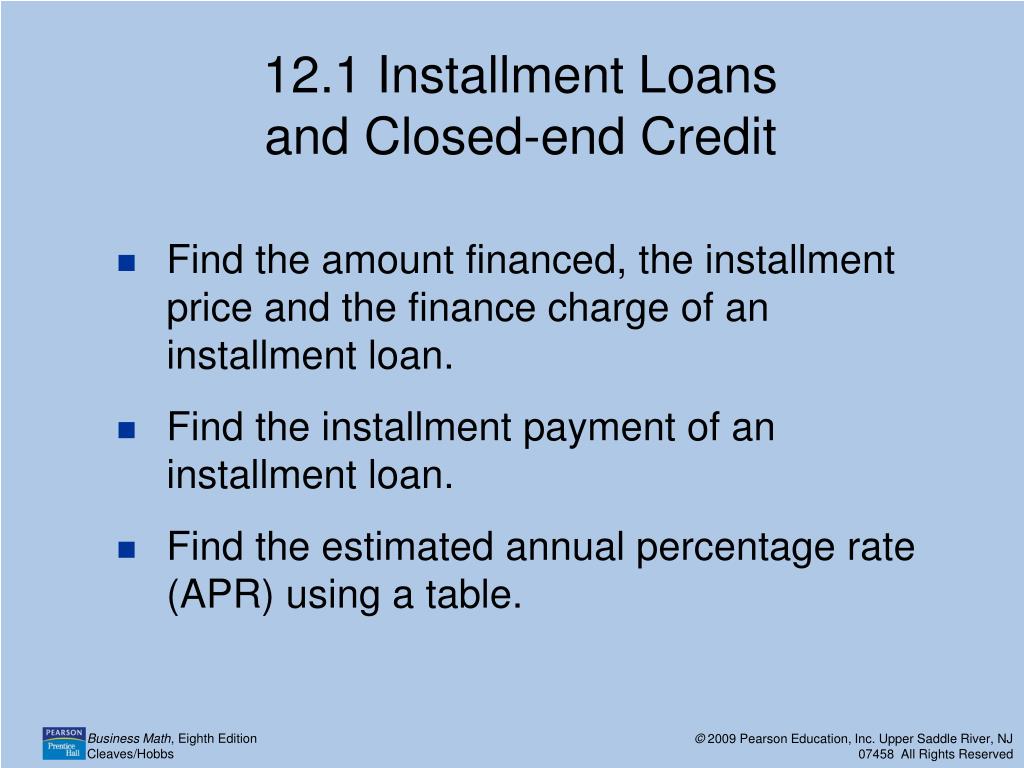

. You must make payments on the loan until the interest and principal are paid off. Closed-end credit facility refers to where borrowed funds can only. Closed-end credit usually has a lower interest rate than open-end credit which makes it better.

On the other hand some. Both may charge fees and an example. A closed-end loan is to be contrasted with an open-ended loan where the debtor borrows multiple times without a specified repayment date like with a credit card.

In a closed-end credit the amount borrowed is. Occasionally you might have closed-end credit with a variable interest rate. Closed-end credit does not offer any available credit or revolve and you cannot modify the terms.

Closed-end credit includes debt instruments that are acquired for a particular purpose and a set amount of time. Lines of credit are different than closed-end loans as we explained previously. Click here to read my more of my analysis on CEFs.

Closed-end and open-end credit differ depending on how funds are disbursed and how payments are made to the account. Close-end credit is a credit arrangement in which the borrower must repay the amount owned plus interest in a specific. Any sort of loan that allows you to make several withdrawals and repayments is known as open-end credit.

There is often confusion between an open-end. With closed-end credit you borrow money once and repay the loan. The borrower can reuse.

Open-end credit is not restricted to a specific use or duration. Some customers want a flexible alternative such as open-ended credit. Closed end credit is a loan for a stated amount that must be repaid in full by a certain date.

Open end loan can be borrowed multiple. Credit asset classes corporate loans high yield bonds etc pay investors interest ie. One example of open end credit is credit cards.

Lines of credit and closed-end loans differ primarily in. A line of credit. Open-end credit also called revolving credit can be defined as a line of credit that gives the borrower a certain limit of credi.

Open end credit can be borrowed repeatedly. The monthly payments and interest rate are fixed. Both of these credits charge interest.

Open-end credit is a revolving credit product while closed-end credit is a nonrevolving lending product. Open-end credit and Closed-end credit. Examples of closed-end loans.

Closed-end credit is a one-time installment loan you usually take out for a specific purpose. With closed end credit you cannot add to what you have borrowed. Thats the core difference between these distinct forms of credit.

What is the difference between open end credit. A closed-end line of credit is a special type of financing facility that combines the benefits of revolving credit and also comes with a predetermined maturity date. Closed end credit must be paid off by a specific set dat.

What is a closed-end credit facility. What are examples of open and closed ended. Open-end loans such as credit cards differ from closed-end loans such as vehicle loans in terms of how money are transferred and whether a consumer who has begun to pay.

Az Big Media Types And Sources Of Forbrukslan Or Consumer Loans Az Big Media

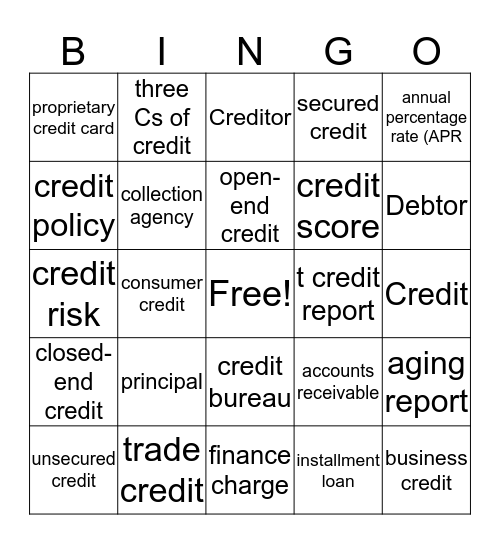

Understanding A Credit Card Ppt Download

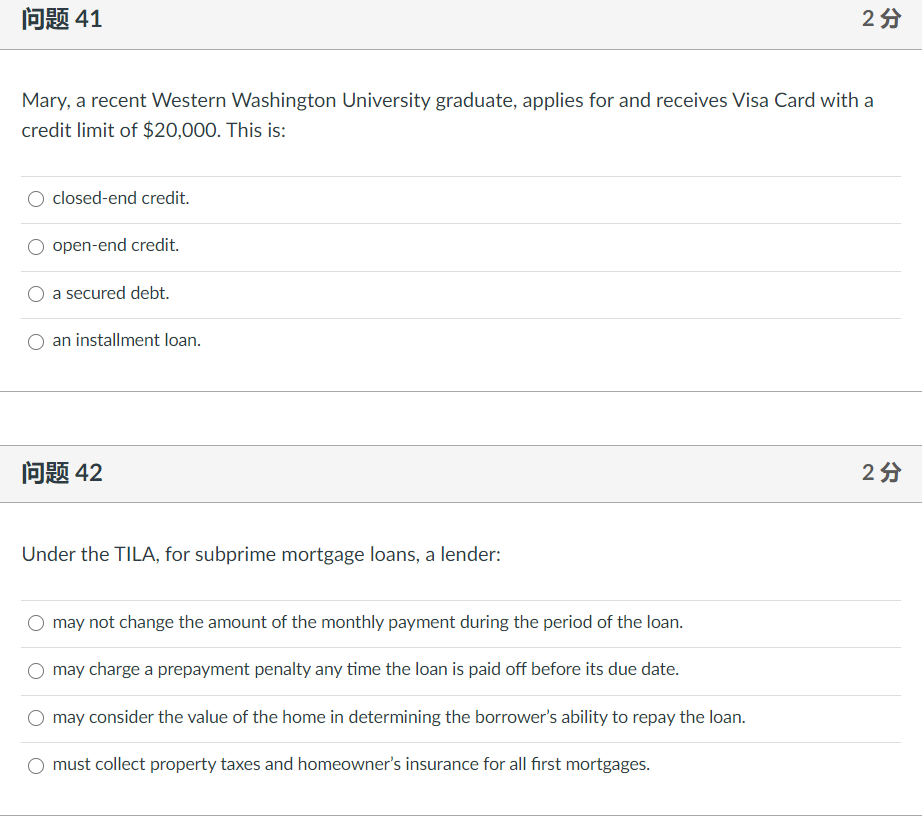

Solved 问题41 25 Mary A Recent Western Washington University Chegg Com

Ppt 12 1 Installment Loans And Closed End Credit Powerpoint Presentation Id 395602

Truth In Lending Act Tila Consumer Rights Protections

Intro To Home Loan Closing Costs Mortgage Closing Costs Box Home Loans

Understanding A Credit Card Take Charge Of Your Finances Advanced Level Ppt Download

Mlo Mentor Section 32 Coverage Tests Firsttuesday Journal

Using A Home Equity Loan For Debt Consolidation

Types And Sources Of Credit Money Management Ii What We Re Doing Today Closed End Vs Open End Credit Loans Different Sources For Different Uses Credit Ppt Download

Open End Versus Closed End Funds An Investors Puzzle

Solved Installment Noninstallment Credit This Type Of Chegg Com

Credit Story Storyboard By 8b4e6879

5 Perks Of Home Equity Loans Midflorida Credit Union

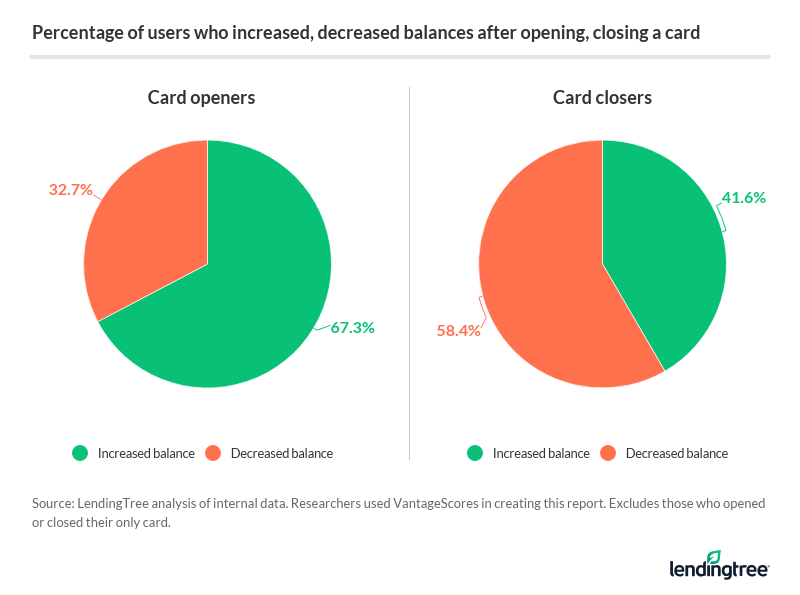

Credit Score Movements When Opening Closing A Card Lendingtree

/GettyImages-923217650-70de1e010cdd4448b137a93421018b33.jpg)